January 24, 2022 · 6 Minutes

3 ways to invest in real estate

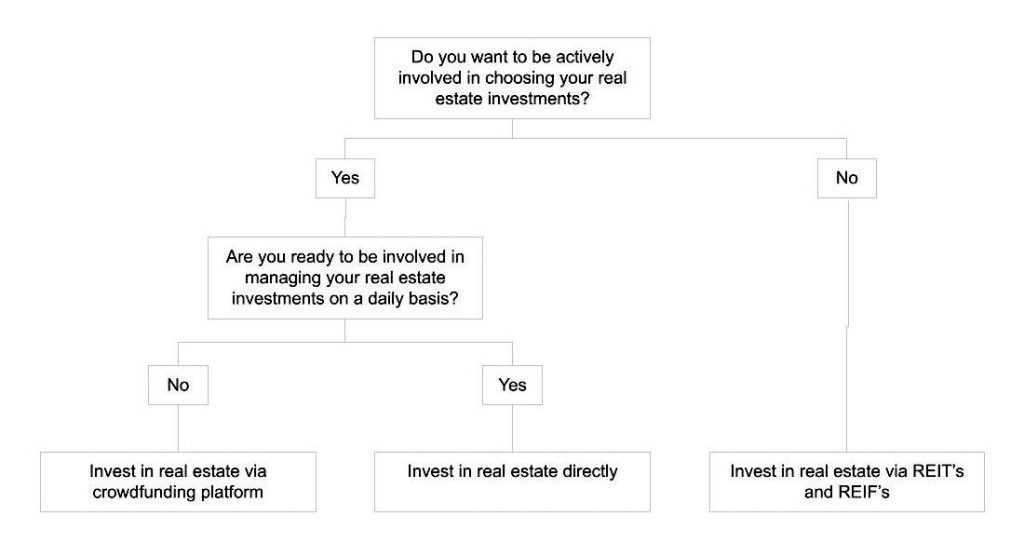

Depending on your willingness to be an active or passive investor and the importance of selecting the real estate investments yourself, there are three fundamentally different ways to invest in real estate. As all options have pros and cons, you should consider each option’s suitability to your preferences.

The following decision tree will help you in choosing the most suitable way to invest in real estate:

Direct real estate investing

When investing directly in real estate, the investor is always becoming an owner of a specific property.

Direct real estate investors earn money via rental income, asset appreciation and/or any business activities that depend on that property. All following investment activities qualify as direct real estate investments:

- Buying an apartment, office or commercial building and renting it out;

- Buying a flat or private house to fix and sell it (fix and flip);

- Purchasing an empty plot to construct a private home and then sell it;

- Buying industrial land to convert it into residential land via a rezoning process;

- Buying a forested land plot to grow and harvest timber, etc.

Direct real estate investing has several pros:

- The investor is always in complete control of the investment, from the very beginning of selecting the investment to managing it during its lifetime until the property’s final sale;

- The investor can define the financing structure of the investment – mainly deciding the leverage of the investment;

- The investor will retain both the free cash flow and the full appreciation of the property.

At the same time, direct real estate investing has several cons:

- Direct real estate investing requires large amounts of capital;

- Building a diversified direct real estate investment portfolio requires even more money;

- Direct real estate investing includes a significant risk of defaulting on financing. As the majority of direct real estate investors are using external financing to pay for their investments, they have to service their debt obligations even if the real estate market crashes or if they have difficulties finding quality tenants;

- Direct real estate investment has relatively high acquisition costs – from initial due diligence to drafting legal transaction documents;

- Direct real estate investing is time- and energy-intensive: identifying, analysing, buying, managing and selling real estate takes a lot of time.

For the reasons stated above, direct real estate investing is practised mainly by professional and institutional real estate investors with dedicated in-house investment management teams and access to large amounts of capital.

REITs and REIFs

REITs and REIFs are similar structures from the investors’ perspective, the key difference being in legal and income distribution details.

REIT is an acronym for a Real Estate Investment Trust, a company established to invest directly in income-generating real estate. REIF is an acronym for a Real Estate Investment Fund, which invests in real estate.

Investing via REITs and REIFs has several pros:

- Investing into real estate via REITs and REIFs provides the investor with access to an immediately diversified real estate portfolio;

- The investment deal flow is managed by the professional investment team, thus saving investors’ time and effort;

- The REIT shares and REIF units are very liquid, allowing the investors to add and withdraw their investments with a click of a button;

- REITs and REIFs provide smaller investors with convenient access to large, professional-grade real estate properties, like office towers, shopping malls, hotels, etc.

Investing via REITs and REIFs has several cons:

- Investors have limited control over the REIT’s or REIF’s investments. All investment decisions are made by the REIT or REIF management team; therefore, the investors have no control over any assets to be included in the portfolio and their acquisition or management terms;

- Investing in REITs and REIFs is accompanied by a lack of transparency, investors not knowing how their money is actually invested and how each property is performing as a part of the more extensive portfolio;

- REITs and REIFs can be very sensitive to fluctuations in interest rates – rising interest rates will cause a drop in the value of REIT and REIF investments, and vice versa;

- The REIT and REIF management fees are pretty hefty regardless of the REIT or REIF’s performance, thus reducing the investors’ net returns.

Still, REITs and REIFs can be excellent ways to add income and growth to investors’ real estate portfolios.

Real estate crowdfunding

Real estate crowdfunding has been around for close to 10 years now, and due to its large pools of pros, it has become one of the primary ways to invest in real estate. In addition, more prominent real estate crowdfunding platforms operate on a cross-border basis, providing their investors access to different regional real estate markets.

Investing via real estate crowdfunding platforms has several pros:

- Investors can make professional-grade real estate investments with minimal initial investment amounts, starting from just 50 or 100 euros;

- The small minimum investment amount allows the investors to build a diversified real estate portfolio with just a few thousand euros;

- The best real estate crowdfunding platforms provide investment opportunities to their investors free of charge, so there are no extra costs to investing via real estate crowdfunding platforms;

- Investors have complete control over their crowdfunded real estate investments and must make their investment picks.

- Real estate companies looking to raise capital via real estate crowdfunding are required to pass the platform’s due diligence process, which is focused on eliminating weak and unsuitable investment opportunities;

- The real estate companies looking to raise crowdfunded capital are disclosing all the relevant information on the real estate project, providing investors with transparency and a complete set of information necessary for making a proficient investment decision;

- The secondary market functionality provides investors with excellent liquidity if needed;

Investing via real estate crowdfunding platforms has a few cons:

- First, management experience and capacity can vary widely in real estate crowdfunding. While most Project Owners are well-qualified and have an extensive proven track record, the others might have less experience and track record.

- Secondly, most real estate platforms publish their projects when they are ready to be published. This might mean there are several simultaneously open real estate projects at one point, and then there are none. Cash drag occurs when the investor has a cash position that he cannot invest due to the lack of real estate investment projects at a specific time.

- Third, building a diversified real estate investment portfolio might take time, as the investor has to add real estate investments to it one by one.

Which way is right for you?

There are three fundamentally different ways to invest in real estate, and no right or wrong answer exists. As you have seen above, each has pros and cons, and all can be a valuable addition to an investor’s portfolio.

Read about 9 key real estate investment trends to follow when making real estate investments.

Start or continue your real investing journey with Crowdestate!