January 22, 2021 · 8 Minutes

Estonian real estate market overview 2021

Reading time: 6 min.

Despite the problems, the housing market is still going strong

The most important keyword of the past 2020 for the real estate market and everything else was COVID-19 (obviously). The virus outbreak started in Estonia in the spring, therefore, changed all the previous predictions of the real estate market. Already in March-April, we saw an insane number of depressive economic forecasts, to what the real estate market reacted with a decreas in the number transactions. However, the decline in the number of transactions only remained a temporary mess for the market.

In the spring, the home purchase decision of many people was postponed, which caused a small price fluctuation in the market. In the second quarter of 2020, the prices of older apartments decreased by about ten percent. The prices of newer apartments were not affected by the COVID-19. This is due to the fact that the transactions reflected in the statistics of new apartments are usually agreed quarter to a year earlier.

The summer came with sunshine and took away the coronavirus, for a while.

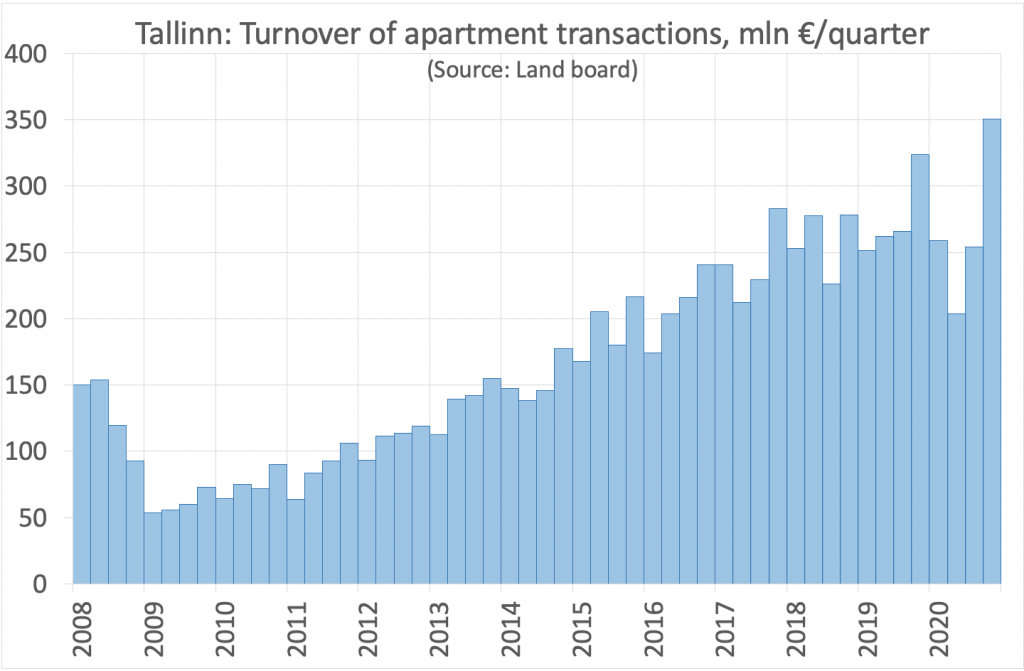

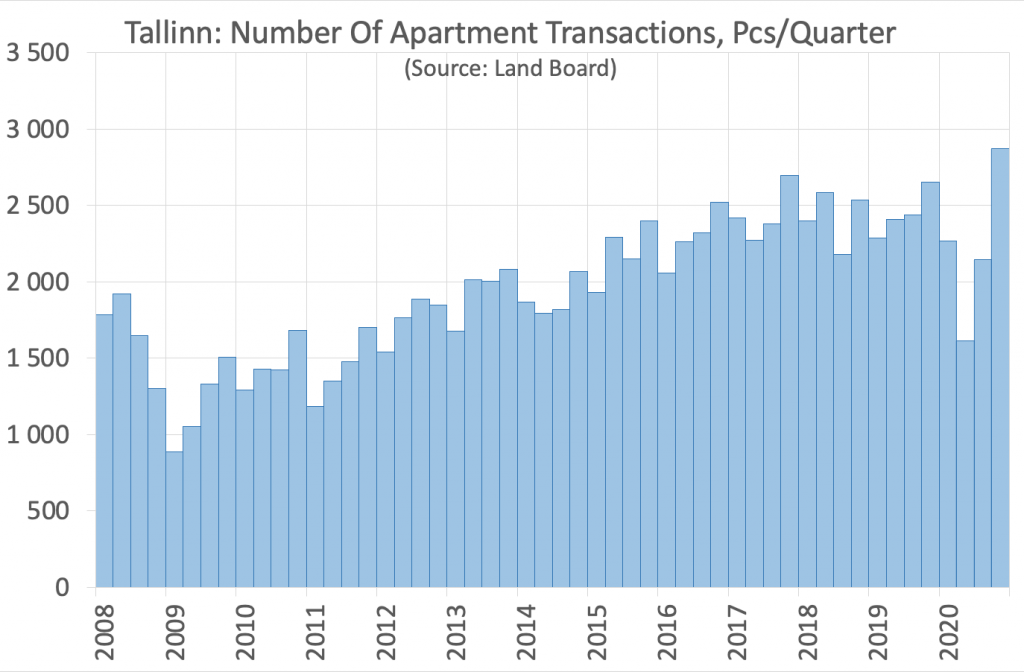

This was accompanied by a strong recovery in the real estate market. Both the number of transactions and prices recovered. The momentary fall in prices in the second quarter of 2020 had practically disappeared by the third quarter. In the last four months of 2020, the number of apartment transactions in Tallinn exceeded the number of transactions before the corona a year ago. In November 2020, a record number of one-month transactions was set for the last twelve years.

In summary, it can be said that in 2020, in terms of real estate transactions and the market, the coronavirus got cancelled as of September.

Demand for housing remains strong

As of 2021, the demand in the housing market is going strong (despite the fact that consumer confidence is negatively low and the number of unemployed is rising). It must be cynically acknowledged that the hotel or restaurant staff that have lost their jobs have not affected the demand for purchases in the real estate market.

The demand is partly driven by both rental investors and home buyers. One of the background forces of both groups of buyers is the rampant printing of money and the expected inflation, ie the rise in real estate prices.

There are sufficient new offers on the market

The housing market supply is not a problem. In the midst of the spring corona crisis in 2020, some real estate developers gathered courage and waited for the market to clear up. When the summer arrived the projects continued. On the supply side, there are new apartments to the same extent as a year ago.

The offers of older houses in the market has not decreased either. (The number of advertisements on the portals speaks another language. The reason for the decrease in the number of advertisements is the increase in the prices of advertisements, not the decrease in the offer.)

The supply of housing on the market cannot be called oversupply. However, the offer can be considered large, i.e. the buyers have bigger say in this. This keeps the price level under control and does not allow prices to rise too fast.

On the one hand, the offers of new apartments, which determines market trends, is fragmented. 70-75% of the offer comes from 20 larger development companies. This means that no independent small developer has sufficient market share to unduly influence market or price trends.

On the other hand, most of the market offers comes from the professional companies. The advantage of professionals managing the market is, that even in the event of possible setbacks, the consumer, i.e. the home buyer, is in safe hands.

Prices remain balanced

Before the COVID-19 virus broke at the end of 2019 and in the first months of 2020, the supply and demand of the housing market were in balance. This gave prices a reasonable opportunity for moderate growth. The increase was at the same level as wages. Thus, the purchasing power of home buyers remained stable.

At the end of 2020 and the beginning of 2021, the situation is more or less the same. The average transaction price in the market is rising, but the structure of transactions, ie the division of transactions between new (or more expensive) and older (or cheaper) apartments, plays a role here.

The value of equivalent living space has remained more or less the same in 2020. True – the price levels of Soviet-era panel flats are a little lower than a year ago.

Corona continues to be the number one risk factor

With the risks of the housing market at the beginning of the year, it is still not possible to bypass the coronavirus. An important question at the moment could be, what is the effect of vaccination on the wider economy and the real estate market in particular?

The next topics that could be brought back to the table are the so-called old problems – trade wars, the longer-term effects of Brexit, the risks arising from the increase in the debt burden of countries and the printing of money. As a more recent matter, the list of risks could include the topic of increasing inequalities due to pandemics and money printing, and possible actions of the public sector in this direction.

In view of the local Estonian economy and the real estate market, the increase in the number of unemployed and the low level of consumer confidence cannot be ignored. In the short term, these problems have not affected the real estate market, but the question is, what will be the longer-term impact? Does the increased debt burden of the Estonian state mean a higher tax burden in the near future?

Next to that, one of the most important questions is when Estonia’s economic growth will recover? Current forecasts expect economic growth to recover in the middle or second half of 2021. At the same time, the corona wave is still rising and the morbidity is ten times higher than a year ago. It is possible that forecasts that have become increasingly positive during 2020 will have to be adjusted back to a more negative side at some point.

Is the future bright?

Last spring clearly showed that in a crisis situation, making long predictions is an intellectually challenge that has little to do with reality. However, it is better to have a poor prognosis than act on an impulse.

In the near future, the housing market could develop without any negative effects. In a situation where the number of transactions is breaking records, it is difficult to expect the number of transactions to continue to grow. Rather, the number of transactions could decline slightly over the next few quarters.

As long as the number of housing transactions is high (i.e. significantly above the historical average), there is no reason to fear a decline in the value of the real estate. The impact on prices could occur if the number of transactions was to decrease significantly due to some unexpected and currently unknown factors, i.e. if buyers were to disappear from the housing market overnight.

Given that the supply is high, there is no reason to expect a rapid, i.e. double-digit price increase. Much more realistic is a moderate increase in prices of 3-8%, one of the main reasons for which is money printing and the demand that operates during it.

What’s next?

The real estate market and the housing market are in a situation where everything is almost too good to be true for all market participants. The market situation is not very different from a year before the corona. At the same time, the economic environment has been completely turned around as of today.

We must be aware that the market has the right to behave irrationally temporarily. In the long run, the market will return to the historical average again and again. The main question is when and in what way will the Estonian real estate market react to changes in the economic environment?