January 1, 2022 · 11 Minutes

Withholding tax and interest income

Reading time: 10+ min.

Highlights

- All major countries have implemented the taxation framework, where income is taxed at source, if possible.

- The double taxation avoidance treaties are concluded between individual countries, regulating the division of the withholding taxes. If and when applicable, part of the income tax is withheld by the payer, and the remaining untaxed part of the income has to be independently declared by the investor in his home country.

Example: An Estonian private resident is subject to an income tax rate of 20% on interest payments. When investing in a Latvian project, 10% income tax is withheld by the Project Owner, which is forwarded to the Latvian tax office. The remaining 10% must be declared by the investor in Estonia himself. - To benefit from the double taxation avoidance treaties, please upload a proper and valid tax residency certificate to to your investment account. The document can be downloaded or requested from from your local tax department.

- In some cases, the application of double taxation avoidance treaties is made ridiculously complex so their acutal application is impossible. Romania, requiring the notarized, apostilled original copy of the investor’s tax residency certificate, translated into Romanian language by sworn translator, and to be presented for each investment individually, is a good example of the existing tax treatry that is inapplicable in real life. Therefore, the income earned by non-resident investors having invested in the Romanian projects, is subject to 16% withholding tax.

Although income tax withholding rules were in place in the mid-19th century, Mr Beardsley Rumi, the director of the Federal Reserve Bank of New York, is considered to be the author of the modern withholding tax system. The US Congress enforced Rum’s proposals with the Current Tax Payment Act of 1943.

Today, the tax withholding obligation is applied to the majority of distributions made by any corporate entity. Withholding tax is deducted from gross payout and the withheld amount is transferred forward to the tax authorities. By creating a withholding tax obligation, the state ensures that any income is taxed before it can be spent by the recipient. The income tax withholding system ensures that the state receives its taxes first, on time and without any credit risk.

The most well-known withholding taxes are income tax, social security tax, pension contributions – they are applied to salary payments.

The taxation of crowdfunding income

An income generated from crowdfunded investments is not different from any other type of income and thus, it is taxed similarly to other income.

The majority of governments are requiring companies to withhold income taxes from any distributions made to their investors.

If the crowdfunding investors have concluded loan agreements with the corporate Project Owner, and the Project Owner makes an interest payment, it has an obligation to withhold income tax from the interest paid out.

If the crowdfunding investors have invested in the Project Owner’s equity, and the Project Owner makes a profit distribution via paying dividends, the Project Owner has an obligation to withhold income tax from the dividend payout.

Applying proper income tax rate

The applicable withholding tax rate generally depends on three major components:

- the Project Owner’s tax residency, which determines the country where the withholding tax is payable and which country’s withholding tax law is applied. For example, if the Project Owner is an Italian company, the Italian income tax regulation is used to determine the withholding tax rate and the withheld tax is transferred to the Italian tax office;

- type of payee can be wither a private person or a legal entity. Several countries have different approaches to taxation of interest payments to individuals and companies, so it is important to differentiate between the type of person receiving the interest income. For example, if the interest is paid by an Estonian company and it is received by a private person and a company, both Estonian tax residents, the interest income payments to the private person will be a subject to a 20% withholding tax and the payments to the company will be a subject of a 0% withholding tax;

- applicable cross-border double taxation avoidance treaties, where the payer of interest and the recipient of interest have different tax residencies (ie they located in different countries), seek the minimization of the double taxation of the taxable income. On the other hand, the double taxation treaties generally ensure that the income earned by the investor is taxed in both countries. In the case of a double taxation avoidance treaty, part of the applicable income tax is withheld by the paying company, and part of the income earned has to be independently declared by the investor in his home country.

The tax withholding obligation occurs at the time the income is paid out.

Applying the correct income tax rate is significantly more difficult if the crowdfunding platform has a secondary market, where its investors can buy and sell their loan contracts. In a complex case, the Project Owner might have to withhold taxes from different persons in different tax regimes – depending on the ownership of the contract at each individual payout occasion.

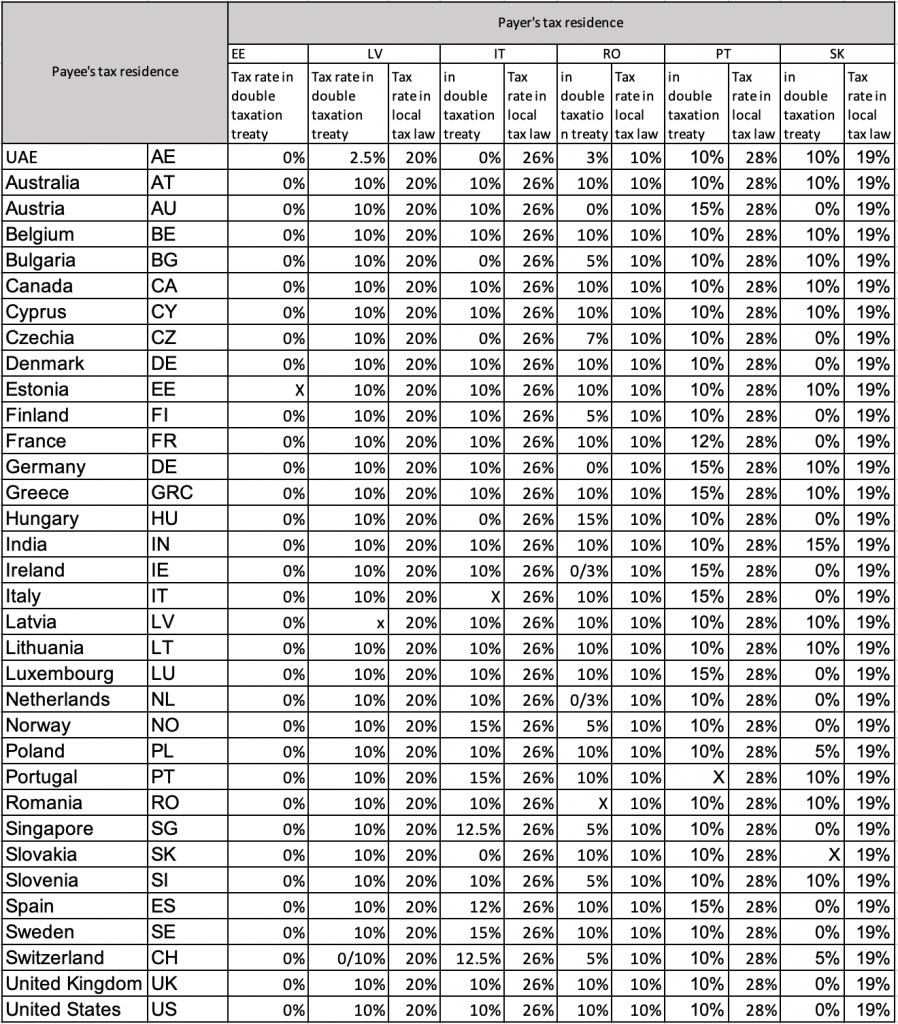

Selected applicable withholding tax rates

| Payee | Private individual |

| Payer | Legal entity |

* Non-resident investors having invested in Romanian projects, are applied with 16% withholding tax.

** All investors investing in Portuguese projects are subject to a 10% withholding tax rate.

Crowdestate’s income tax withholding process

Crowdestate is one of the rare European crowdfunding platforms that helps its Project Owners to eliminate their operational tax risk by applying proper withholding tax rates to their interest payouts.

In order to make income tax withholding easier for the Project Owner, the income tax withholding occurs as follows:

- the Project Owner makes a gross interest payment to Crowdestate’s client account;

- Crowdestate checks, at the moment of the distribution of the interest payment, the type of beneficiary, his tax residency and the availablility of the tax residency certificate, the existence of a double taxation avoidance treaty and determines the proper withholding tax rate;

- the gross interest payment received from the Project Owner is credited to the investor’s investment account and at the same moment, his or her investment account is debited in the amount of withheld income tax. In the event that one investment opportunity or the Project Owner makes multiple interest payouts within a single calendar month, the tax withholding procedure described above is applied to all interest payouts;

- The withholding tax will remain on Crowdestate’s segregated client account until the end of the current calendar month;

- On the first day of the next calendar month, Crowdestate shall automatically transfer the withheld income tax amount back to the Project Owner. At the same time, Crowdestate provides the Project Owner with all reports and files that are necessary for filing tax declarations;

- The Project Owner uses the received tax payment and the reports to file the tax declaration.

Regarding the application of proper withholding income tax rate and the subsequent filing of tax declaration, it is extremely important that Crowdestate has up-to-date information on the investor’s tax residency and other personal data (including his social security number or ID code) at all times. Incomplete or incorrect data would lead to the application of incorrect, potentially higher, withholding tax rates and would cause technical problems for the Project Owner when filing its tax declarations.

A good example of an impact of tax residence change is when Crowdestate’s investor who has lived in Estonia leaves the country to live and work abroad, duly notifies the Estonian Tax and Customs Board of a change in tax residence, but forgets to change his tax residence data in his Crowdestate investment account. Therefore, when calculating and applying the income tax withheld from the interest payments, the 20% withholding tax rate would be applied to him even if his new tax residence would allow the application of a lower income tax rate. In the best case, the Project Owner manually adjusts their tax declaration later, but in most cases, the investor loses the excess amount of income tax forever.

Income tax report

Crowdestate prepares a full tax withholding report for each investor, the report can be downloaded from the Investment Portfolio section.

The tax report lists names and corporate details of each Project Owner along with the gross interest income and amount of withheld income tax.

Income tax declaration

When the withholding tax rate is lower than the investor’s domestic income tax rate, the investor would need to declare the non-taxed part of the income and pay the additional income tax.

Examples

Project Owner 1 AS is an Estonian tax resident company with two investors: Private Person A and Small Business OÜ. Both investors are Estonian tax residents as well. Project Owner 1 AS will pay interest to both investors in the amount of EUR 1,000.

While making the interest payment, Project Owner 1 AS applies the following income tax withholding rates:

- Interest paid to Private Person A is subject to a 20% income tax withholding, so 1 AS will withhold a sum of EUR 200, and the net payout is EUR 800;

- Interest paid to Small Business OÜ is subject to a 0% income tax rate, so 1 AS does not withhold income tax and Small Business OÜ receives the gross interest amount (EUR 1,000).

Project Owner 2 srl is a Romanian tax resident company with three investors: Private person A is an Estonian tax resident, Private Person B is a German tax resident, Private Person C is an Italian tax resident and Small business srl is also an Italian tax resident. Project Owner 2 srl will pay out interest income of EUR 1,000 to all investors. Due to the additional requirements of Romanian tax legislation, the preferential withholding rates are not applicable.

Under Romanian tax laws, the Romanian company has an obligation to withhold income tax from the interest distributions.

In making the payment, Project Owner 2 srl applies the following rates of income tax:

Interest paid to Private Person A should be subject to a 10% income tax rate, but Private Person A has not provided the original translated, notarized and apostilled copy of his tax residency certificate, so Project Owner 2 srl will apply a 16% withholding tax and withhold the payment of EUR 160. NB! As the income of the Estonian private tax resident is taxed variably according to his or her actual income, the Estonian private tax resident is obliged to declare the untaxed part of the interest income independently. Assuming that income earned by Private Person A is subject to a 20% income tax rate, the person would have an additional income tax liability of 4%. The same applies to the non-resident investors (person B and C)and a 16% tax withholding will be applied.

Interest paid to a Small Business srl is subject to a 16% income tax rate, and while a double taxation avoidance treaty between Italy and Romania provides for a 5% tax rate on the distributions made to legal entities, it is technically inapplicable. Therefore, Project Owner 2 srl will withhold payment of EUR 160.

Disclaimer

The information above intends to give a broad and general overview of taxation and tax withholding principles and should not be taken as tax advice. The provided examples are general and illustrative. The final taxation and individual tax rate of a particular investor may depend on many other individual factors. Therefore, all specific tax questions should be addressed to a professional tax advisor.

This article has not been coordinated with tax authorities in different countries and there is no assurance that tax officials will not take a different view. While writing the article, we have relied on the tax laws in force at the time, and we will not have any obligation to update the tax rates or other information contained in this article. Crowdestate is not responsible for any loss, damage or expense that may result from reliance on this information.

In case of further questions, please contact a tax advisor.