May 4, 2023 · 12 Minutes

Ultimate guide to Autoinvest 2.0

Crowdestate’s Autoinvest has been around for years, and our investors have set up thousands of Autoinvests to simplify their daily investment activities and save valuable time. Introduced in 2015, Autoinvest started as a simple investment order submission tool and gradually became a sophisticated, multi-parameter platform feature.

With Crowdestate becoming a licensed pan-European real estate crowdfunding platform, we have decided to redesign our Autoinvest, removing some redundant features and adding some new ones, that will allow our investors better to control the investment risks on their portfolio level.

What is Autoinvest?

Autoinvest is an automated investing tool which uses the parameters set by the investor to submit loan offers to the crowdfunding offers meeting the investment criteria. Autoinvest is available to all investors free of charge.

European Crowdfunding Regulation has defined Autoinvest as individual portfolio management of loans, which means the allocation by the crowdfunding service provider of a pre-determined amount of funds of an investor, which is an original lender, to one or multiple crowdfunding projects on its crowdfunding platform in accordance with an individual mandate given by the investor on a discretionary investor-by-investor basis.

What are the benefits of Autoinvest?

Time is the most valuable resource; thus, it should be used sparingly on activities that add value.

Crowdfunding is all about making a large number of relatively small investments into different crowdfunding projects located in different countries and being executed by different project owners. When you are investing a few hundred euros at a time, it makes sense to automate your investment activities in a way, that will result in a well-diversified real estate investment portfolio, meeting some additional risk and return-related investment parameters.

There are several valuable benefits of using Autoinvest:

- You will never miss a crowdfunding offer that fits your return expectations and risk tolerance;

- You will save a ton of time by automating your investment activities;

- Smartly defined Autoinvest will build a diversified real estate investment portfolio for you, you just have to add funds to your investment account;

- Autoinvest is free of charge;

- You can edit, pause or terminate your Autoinvest at any time.

How does Autoinvest work?

You need to have an investment account with Crowdestate to use Autoinvest.

After opening an investment account with Crowdestate, you are ready to set up your Autoinvest (see detailed instructions below).

Once you have defined your investment parameters and activated Autoinvest, Autoinvest will start submitting loan offers to all published crowdfunding offers meeting your individual investment criteria.

There are two important things to keep in mind:

- Autoinvest will work with loans only. Due to regulative restrictions, you are not allowed to use Autoinvest for making equity investments;

- Autoinvest will submit loan offers to all crowdfunding offers published after the activation of Autoinvest. Autoinvest will not submit loan offers to already published crowdfunding offers.

Once the loan offer made by Autoinvest is approved and settled, a loan contract between you and the project owner is concluded on exactly the same terms as with the investors, who have submitted their loan offers manually. The concluded loan contracts are stored under the Contracts section of your investment account.

You can set up specific notifications to receive emails on the activities of your Autoinvest to stay informed.

How to set up an Autoinvest?

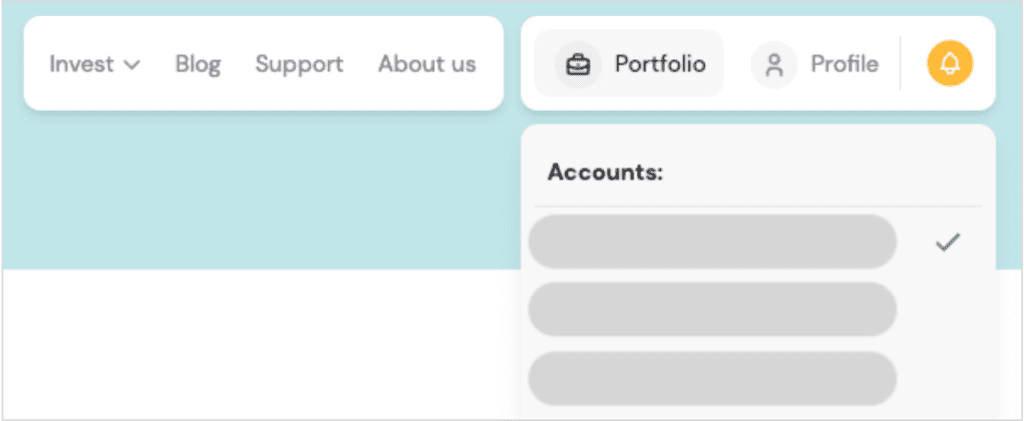

Once you have created an investment account, click on the Portfolio tab in the upper right corner of the website:

Autoinvest is attached to the specific investment account. If you decide to have more than one investment account with Crowdestate, select the investment account to which you will attach your Autoinvest.

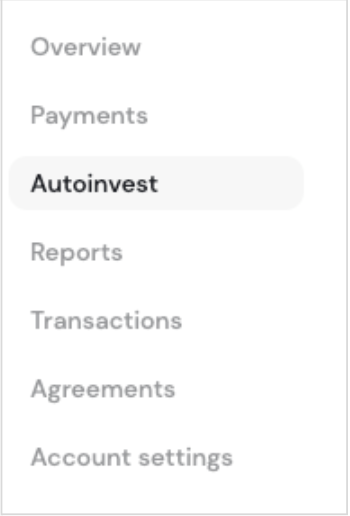

Next, in the left menu, you will see a link that leads you to the Autoinvest page.

Click on the “Add Autoinvest” button to set up your Autoinvest.

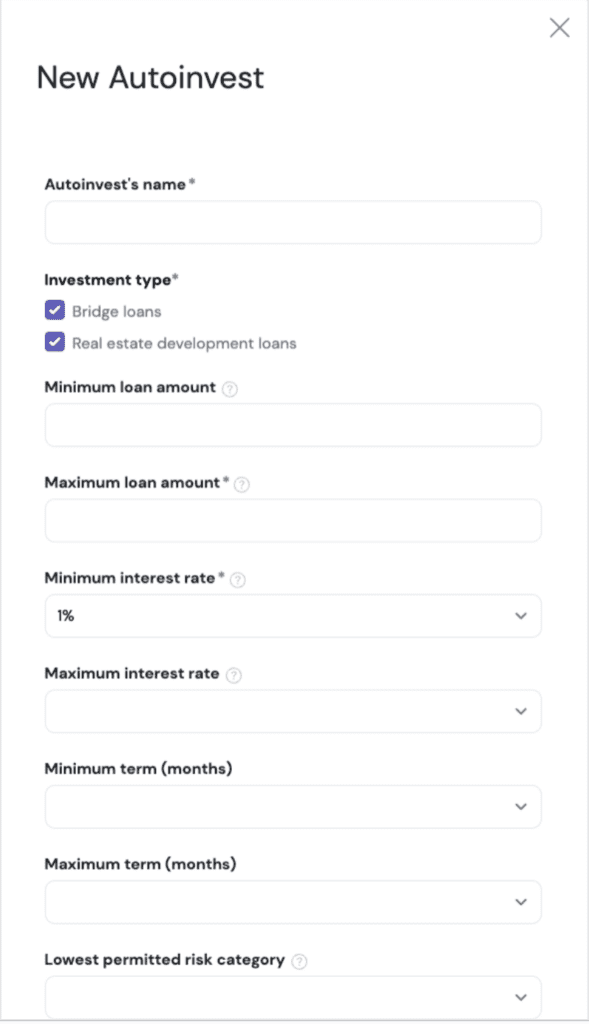

You will see the following new Autoinvest setup screen:

Autoinvest’s name

Start by giving your new Autoinvest a name. There are no restrictions to naming your Autoinvest, and we recommend giving your Auotinvest a name, that will allow it easily identify your Autoinvest (especially if you are going to set up several Autoinvests for that investment account).

Loan types

Next, select the types of loans that Autoinvest would be submitting loan offers to.

- Bridge loans are short-term loans granted against the collateral. A bridge loan is a form of short-term financing that can serve as a source of funding and capital until the project owner secures permanent financing or sells the collateral. In most cases, there is no improvement to the valuer of the collateral.

- Real estate development loans are used to finance real estate development and construction activities. The project owner is actively adding value to the crowdfunding project and the source of repayment is the sales of the completed project (apartments, houses etc).

Unless you have specific investment limitations, we recommend selecting both types of loans to ensure the maximum diversification of your portfolio. Alternatively, you can set up one Autoinvest for real estate development loans and the other one for bridge loans.

Minimum loan amount

Minimum amount of the loan is the minimum value of one loan offer made to one crowdfunding offer. By default, the value of the minimum loan is EUR 100.

When you decide to establish a value for the minimum loan amount, Autoinvest will submit a loan offer of at least the minimum loan amount but not more than the maximum loan amount limit.

When your investment account’s cash balance is less than the minimum loan amount limit, Autoinvest will not submit the loan offer.

You could consider defining the minimum loan amount in case you have a relatively large investment portfolio with Crowdestate and you need to keep it invested at all times.

Crowdestate is currently publishing several hundred crowdfunding offers a year and the average duration of all published crowdfunding offers is less than a year. If you would invest just EUR 100 into each published crowdfunding offer, your annual investment volume would be about EUR 20 000. If your investment portfolio is larger than EUR 20 000, you could consider establishing a minimum loan amount higher than EUR 100.

Maximum loan amount

The maximum loan amount is one of the two mandatory Autoinvest parameters required by the European Crowdfunding Regulation.

The maximum amount of one loan offer made to one crowdfunding offer. Autoinvest will never submit a loan offer exceeding this value.

As long as the value of your total real estate investment portfolio with Crowdestate remains below EUR 20 000, we recommend that you set this value to EUR 100 to ensure maximum diversification of your investment portfolio.

Minimum interest rate

You can also define the maximum interest rate of the loan. In such a case, Autoinvest will not submit loan offers to crowdfunding offers providing interest rates higher than your established limit.

We recommend that you do not set this parameter unless you a looking to limit the maximum return of your loan offers.

Minimum term

When you have defined the loan’s minimum term (length), Autoinvest will not submit loan offers to crowdfunding offers that are shorter than you defined.

We recommend leaving this parameter empty unless this is required by your specific investment needs.

Maximum term

When you have defined the loan’s maximum term (length), Autoinvest will not submit loan offers to crowdfunding offers that are longer than you defined.

Highest permitted risk category

Crowdestate uses investment risk categories to display the relative riskiness of crowdfunding projects published on the platform. The crowdfunding offers with risk category A have the lowest relative risk (and return), and the ones categorised as E have the highest relative risk.

Please select the highest appropriate risk category from the dropdown menu.

Autoinvest will submit loan offers only for the loans with a risk category lower than or equal to the risk category you have specified. For example, if you have set the maximum risk category of a loans to be D, Autoinvest will make loan offers for loans with a risk category of A, B, C or D and will not make investment offers for loans with a risk category of E.

Please see the overview of Crowdestate’s risk assessment model here.

Highest permitted LTV

When you define the maximum permitted LTV of any loan, Autoinvest will submit loan offers only for loans with an LTV lower than or equal to the maximum LTV value you have set.

For example, if you have set the maximum LTV to 80%, Autoinvest will submit loan offers on all loans with an LTV of 80% or less.

Maximum exposure per project

The investment limit per one crowdfunding project helps limit the risk you take against one crowdfunding project.

In the case of a crowdfunding project consisting of several crowdfunding offers, Autoinvest will submit loan offers for such a crowdfunding project until the monetary value of the limit is reached.

For example, assuming that:

– the crowdfunding project is about raising secured loans to finance construction activities;

– the crowdfunding project consists of 12 crowdfunding offers to be published within a 12-month period;

– Autoinvest submits loan offers of EUR 100 on your behalf; and

– an investment limit of EUR 500 per one crowdfunding project set by you.

In this case, Autoinvest will submit loan offers of EUR 100 for this crowdfunding project’s first five crowdfunding offers. As you will reach your investment limit of EUR 500 then, Autoinvest will not submit loan offers in crowdfunding offers 6 – 12.”

Maximum exposure per project owner

The investment limit per project owner helps limit the risk you take against one project owner.

A project owner is a legal person who seeks funding through a crowdfunding platform.

In case a project owner is funding several different crowdfunding projects simultaneously through Crowdestate, Autoinvest will submit loan offers to these crowdfunding projects until the monetary value of the limit is reached.

Maximum exposure per UBO

The investment limit per UBO helps you to limit the risk you take against the same beneficial owner controlling different project owners.

UBO is a widely-used acronym designating the ultimate beneficial owners of a company. An ultimate beneficial owner is essentially a private person controlling the activities of the company and reaping financial benefits from the company’s operations. For the purposes of this limit, Crowdestate considers a UBO to have at least 50% direct or indirect ownership in the project owner.

In case the same person controls different project owners who raise loans for different crowdfunding projects through Crowdestate, Autoinvest will submit loan offers in crowdfunding projects linked to that person until the monetary value of the limit is reached.

Saving and activating your Autoinvest

When you have defined the necessary investment parameters of your Autoinvest, click on the “Save” button to save and activate your Autoinvest.

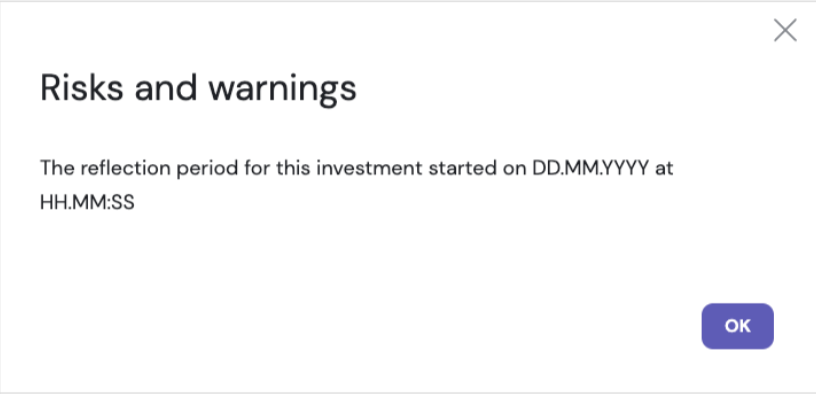

You will see the legally required risk and warning notifications, as well as the notification about the start of the 4-day reflection period.

Click on “OK” to proceed to the activation of your Autoinvest.

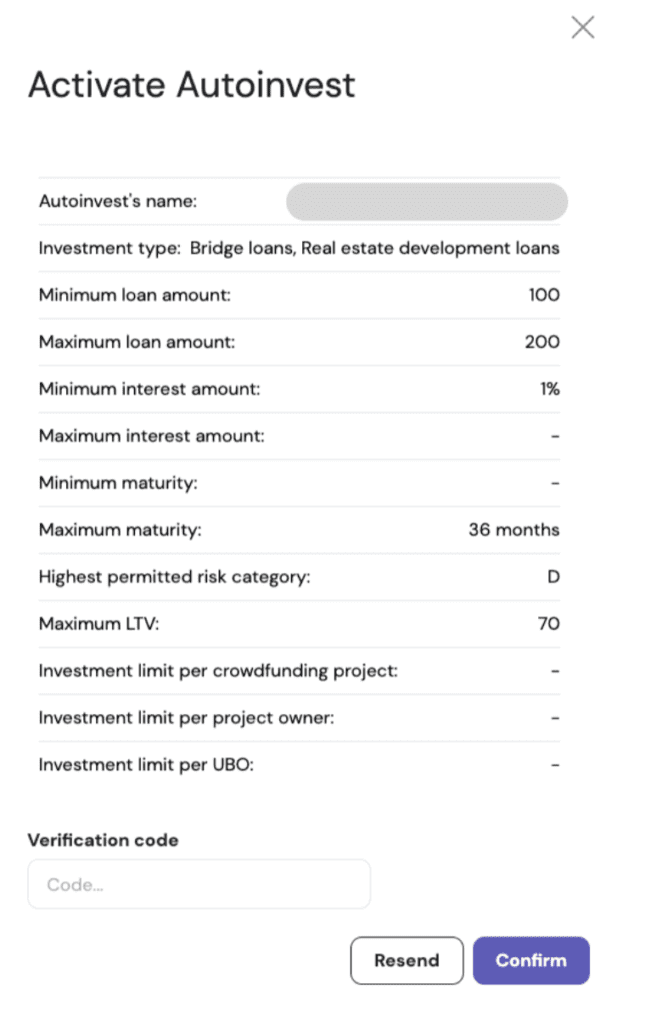

You will see the overview of your Autoinvest’s parameters – please review them before final approval and activation of Autoinvest.

Enter your two-factor authentication code from your Google Authenticator or a single-use code from the SMS message sent to you.

All your Autoinvests connected to this investment account will be displayed on the investment account’s Autoinvest page.

In case you have questions about creating Autoinvest or its investment process, do not hesitate to send us an email at info@crowdestate.eu.

Log in to your account and create your Autoinvest to automate your investments with Crowdestate.